By Jeff Weniger, CFA, Head of Equity Strategy

作者杰夫•韦尼格,CFA,股票策略主管

“Nessie.” That’s the nickname for the lake-living, reclusive beast that has lured spellbound tourists to a fabled Scottish lake—Loch Ness—for decades. This raging stock market has gotten to such a point that you could be forgiven for thinking the Loch Ness Monster hoax is more believable than claims of spotting a low P/E equity basket these days.

“尼斯湖水怪。“尼斯湖水怪”是对生活在湖中的隐居野兽的昵称,几十年来,它一直吸引着着迷的游客来到苏格兰传说中的尼斯湖。疯狂的股市已经到了这样一个地步,你会认为尼斯湖水怪的恶作剧比声称发现了一个低市盈率的股票篮子更可信,这是情有可原的。

By and large, there is not much you can do if you want a really low P/E in the U.S.—not with the S&P 500 Index loitering around 3,800, its forward P/E at 23.

总的来说,如果你希望美国的市盈率真的很低,你就无能为力了——除非标普500指数徘徊在3,800左右,其远期市盈率为23。

To get there, you might consider turning to emerging markets (EM).

要实现这一目标,你或许可以考虑转向新兴市场。

We have a couple of Funds that own a bunch of inexpensive stocks, the type of Funds you might own when you are decidedly bulled up on value relative to growth.

我们有几只基金持有一些便宜的股票,当你的价值相对于增长明显看涨时,你可能会持有这类基金。

Here are two of our deepest value ideas:

以下是我们两个最深刻的价值观念:

DGS: The WisdomTree Emerging Markets SmallCap Dividend Fund

DGS: The WisdomTree Emerging Markets SmallCap Dividend Fund

DEM: The WisdomTree Emerging Markets High Dividend Fund

DEM: WisdomTree新兴市场高股息基金

If you think 2021 will witness stocks with no dividends winning again, you don’t want these. But if you are scouring the landscape for companies with low multiples, these are the two Funds to investigate.

如果你认为2021年将再次见证无股息股票的上涨,那么你不会想要这些股票的。但如果你要在市场上寻找市盈率较低的公司,这两家基金是值得调查的。

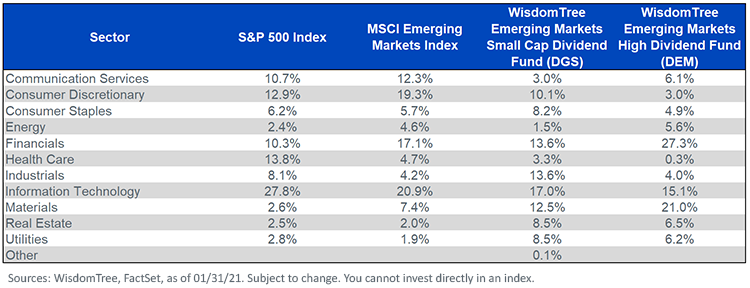

Note the return on equity (ROE) percentages in figure 1. Pretty good for EM value, right? Both DGS and DEM are higher on that measure than the MSCI Emerging Markets Index, with notably lower P/Es. Additionally, the dividend yields are several percentage points higher than the 1.55% of the S&P 500.

注意图1中的净资产收益率(ROE)百分比。对EM价值来说很不错,对吧?按照这一标准衡量,DGS和DEM均高于MSCI新兴市场指数,市盈率明显较低。此外,股息收益率比标准普尔500指数的1.55%高出几个百分点。

Figure 1: DGS & DEM’s Valuations

图1:DGS和DEM的估值

For standardized performance of the Funds mentioned in the table please click their respective tickers: DGS, DEM.

如欲了解表中所列基金的标准化表现,请按其各自的代号:数字、数字和数字。

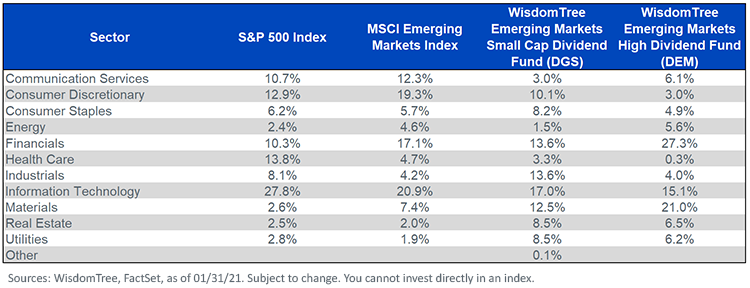

Like your search for Nessie or Bigfoot, you could be looking for a long time if you expect to stumble upon big slugs of Tech or Consumer Discretionary in DGS or DEM. These are reflation-based Funds that are overweight Basic Materials and Real Estate (figure 2).

就像你寻找尼斯湖水怪或大脚怪一样,如果你希望在DGS或DEM中偶然发现大量的科技产品或非必需消费品,你可能需要花很长时间。这些是基于通货再膨胀的基金,它们在基础材料和房地产方面的投资比重过高(图2)。

Figure 2: Sector Weights

图2:扇区权重

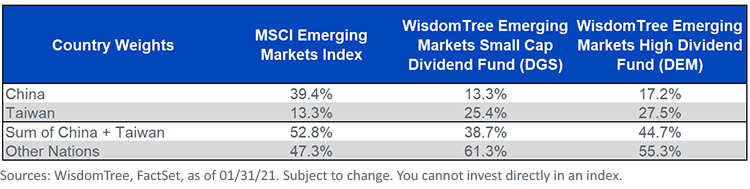

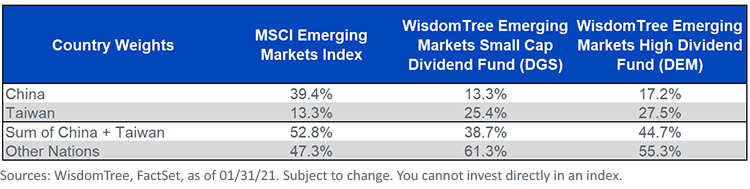

Another thing: DGS and DEM are underweight China (figure 3).

另一件事:DGS和DEM的权重都低于中国(图3)。

Figure 3: China + Taiwan in DGS & DEM

图3:DGS和DEM中中国+台湾

If you are bullish on China relative to the rest of EM, then look away from DGS and DEM and toward something like the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE), which has more in that country.

如果你相对于其他新兴市场看好中国,那就把目光从DGS和DEM转移到WisdomTree Emerging Markets ex-国有企业基金(XSOE)之类的基金上,该基金在中国拥有更多资金。

For the rest of you, guess what, value hunters content with an underweight in China, guess what? Unlike Nessie, DGS and DEM do exist.

对于其余的人来说,你猜怎么着,价值追求者满足于在中国的减持,你猜怎么着?不像尼斯湖水怪,DGS和DEM确实存在。

Finally, to reiterate a critical argument: look again at the ROEs in figure 1 on DGS and DEM. That profitability measure is a touch lower than the S&P 500for both DGS and DEM, yet the two Funds trade at 10.1 and 8.4 times forward earnings, respectively. In 2021, those multiples could be about as rare as a Bigfoot sighting.

最后,重申一个关键论点:再看看图1中关于DGS和DEM的roe。DGS和DEM的盈利能力指标都略低于标准普尔500指数,但这两只基金的预期市盈率分别为10.1倍和8.4倍。到2021年,这种倍数可能会像大脚怪一样罕见。

Originally published by WisdomTree, 3/5/21

最初由WisdomTree出版,3/5/21

Important Risks Related to this Article

与本文相关的重要风险

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of these Funds, they may make higher capital gain distributions than other ETFs.

投资有风险,包括可能的本金损失。外国投资涉及特殊风险,如货币波动或政治或经济不确定性造成的损失风险。专注于单一行业和/或规模较小的公司的基金通常会经历更大的价格波动。新兴市场、离岸市场或前沿市场的投资一般比发达市场的投资流动性较差,效率较低,并受到额外的风险,例如不利的政府管制、干预和政治发展的风险。由于这些基金的投资策略,它们可能获得比其他etf更高的资本收益分配。

Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.Read more on ETFtrends.com.

请参阅各基金的招股说明书,以了解有关基金风险概况的详细资料。更多信息请访问ETFtrends.com。